Why Invest in Biotech Now?

The short answer is because, at Tanka Ventures, we believe Biotech has reached its most crucial inflection point. Relevant technology has significantly advanced, related costs have drastically reduced and certain emerging new areas of Biotech are introducing new revenue-driven models that historically were not associated with early-cycle Biotech companies. In addition, in the post-COVID-19 world, as we see it, Biotech will no longer be limited to just therapeutics and diagnostics, but we will also see more exciting Biotech applications in other industries such as nutrition, cosmetics, and organic paints, to just name a few.

Introduction

If entrepreneurs are given access to a new tech or infrastructure, they will surprise you with innovative applications that can address your needs in ways you would have never thought possible. Usually, the best solutions involve applications that are applied across industry boundaries. Uber is a great example of this. Their application of the GPS infrastructure transformed mobility.

Over the past decade, Biotech has acquired a reputation of being risky and it will not be difficult to find Wall Street investors lamenting they “have lost their shirt” investing in it. Stars like Genentech aside, the financial markets have been littered with small-capitalization Biotech firms that eventually faded away as their money ran out. However, a number of new trends may now be improving the risk profiles of Biotech companies.

Breakthrough technologies are usually prohibitively expensive at the beginning, but they become more widely accessible over time. In Biotech they are getting cheaper, better, and more accessible and at the same time, several exciting new techs and methods are now also forcefully coming into play. We now seem to be entering an era where investing in certain early-cycle Biotech companies may generate outstanding risk-adjusted returns, while healthcare and other key industries of our economy are being transformed.

Drastic reductions in the cost of sequencing technologies, automation, increasing computing power and advances in machine learning are completely changing the odds of success in the Biotech betting game.

DNA sequencing

How do you assemble around 6 billion As, Cs, Gs, and Ts[mfn]“As” refer to an adenine (A); “Gs” refers to a guanine (G); “Ts” refers to a thymine (T), and “Cs” refers to a cytosine (C).[/mfn], comprising the diploid genome[mfn] “Diploid” refers to the fact that every cell in an organism has two copies of each type of chromosome, while another word for “genome” is the total genetical make-up of an organism (i.e. the total sum of one’s DNA).[/mfn] of an individual, in the right order? This – in essence – is the challenge faced by each genome-sequencing project. Experts tell us, this involves both issues of handling scale and sequence complexities, such as repeated elements.

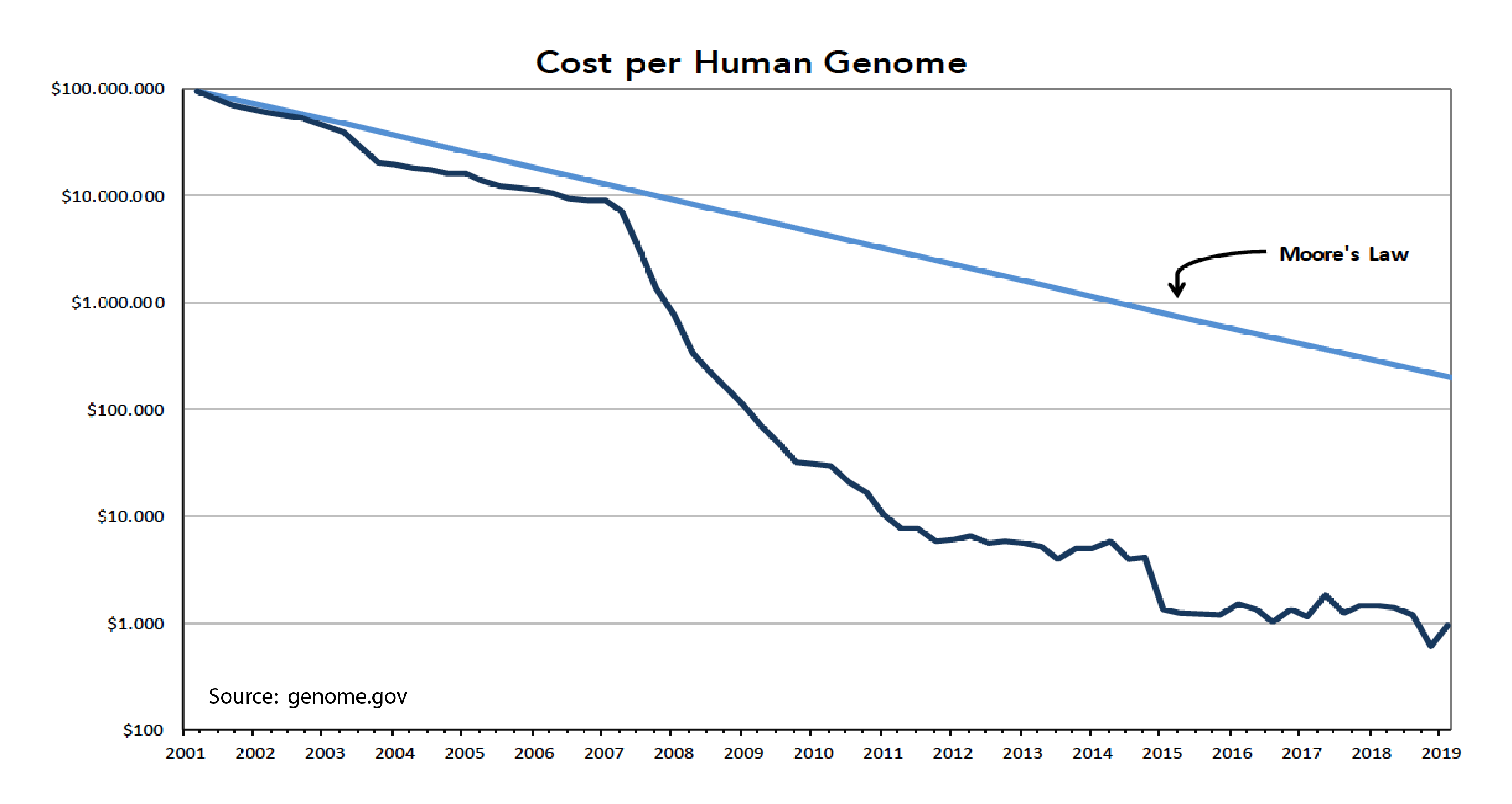

The first complete bacterial genome was published 25 years ago. In 2003, the first human genome sequencing project was completed. The human genome project lasted 13 years and cost the US Congress and its international collaborators $2.7 billion. In the US, the average cost of sequencing a human-sized genome has plummeted substantially faster than the predictions of Moore’s law for computing power. From circa $10 million in 2007 while the cost of sequencing the human genome is now hovering at around $1000.

Sequencing genomes drives the scope and size of all projects in the Biotech sector. With advances in the field of genomics, the cost of genome sequencing has not only plummeted, but these sequences have also become more complete and accurate.

In comparison to the previously used first-generation Sanger sequencing, the second-generation techniques have allowed much faster sequencing of DNA and RNA, at a lower cost and at scales at or beyond genome sizes. Throughout the last decade, these new techniques have revolutionized the study of genomics and molecular biology. However, now experts see the emergence of a third-generation of sequencing technologies with their distinguished feature of long single-molecule sequencing reads. With read lengths of up to tens of thousands of base pairs on single molecules, it is said to be pushing genome assemblies to unprecedented quality. As a result of these ever-evolving sequencing technologies, the rapid progress in personal genome sequencing is becoming increasingly more feasible.

Lab automation has made biology experiments faster, more reproducible, and cheaper

Traditionally, biological lab work involved scientists repetitively moving around tiny bits of liquids with a pipette and then looking at them under the microscope. While this is clearly a caricature that fails to capture the significant creative work scientists do, it does put in perspective the fact that now robots are available, at a fraction of their previous costs, to move liquids instead of scientists. In addition, exciting machine vision SaaS[mfn]“SaaS” refers to “software as a service”.[/mfn] platforms are there to analyse and help interpret findings. While the robots are replacing the pipette work, machine vision platforms give researchers fast results in a potentially more accurate and efficient fashion.

Artificial Intelligence (AI)

The big revolution in Biotech is likely to be facilitated by AI. Biology is such a complex field that scientists say that they can only comprehend just a small fraction of how living organisms behave and function as they do. AI promises to enable the conduct of experiments much more efficiently, faster, and cheaper. Furthermore, AI allows scientists to create systems that can process large amounts of data and output results without necessarily understanding all the intricacies of the organisms being considered. Advances in these technologies are enabling new early-cycle companies to better experiment, develop products, and more effectively access markets that fit their offering.

The long-cycle therapeutics R&D model cannot be undone

Even with the significant benefits of the technological advances highlighted so far, Biotech does and will continue to require large allocations of capital, time, and the creative energies of uniquely qualified teams of scientists and technical talent. Biotech makes bioactive substances to put into patients, maybe even permanently engineer their genes. In this context, performance will always be driven by the careful development of optimized drug candidates that are likely to complete the full regulatory trial process for approval. The long-cycle therapeutics R&D model that was developed over the past decades will, therefore, remain intact. This is evidence by unsuccessful efforts to reduce the number of iterations of the trial concepts and the shortening of feedback cycles. As a result, credible executives with a proven track record, both in running scientific programs and closing business development deals, will remain the key to success in Biotech therapeutics.

Emerging new Biotech areas and Biotech applications in other industries

Typically, early-cycle Biotech companies do not generate operating revenues from product sales. Instead, they start the process of developing drugs and treatments for patients in well-controlled, scientifically-justified experiments, or trials, and these trials take time. This in contrast to companies in other segments of the tech sectors such as software development or consumer services. These companies start by immediately testing the market potential for their products. However, in Biotech we are now starting to see similar revenue-driven models in emerging new areas of Biotech like Contract Research Organisations (or CROs), synbio service companies, or B2B life science businesses.

Furthermore, we also observe that Biotech is no longer limited to just therapeutics and diagnostics. Biotech companies have been creating many attractive products that provide exciting applications in other industries, such as nutrition, cosmetics, and organic paints, to name a few.

That is why Biotech is one of Tanka Ventures’ four preferred Sectors for investments!

Post a Comment

You must be logged in to post a comment.